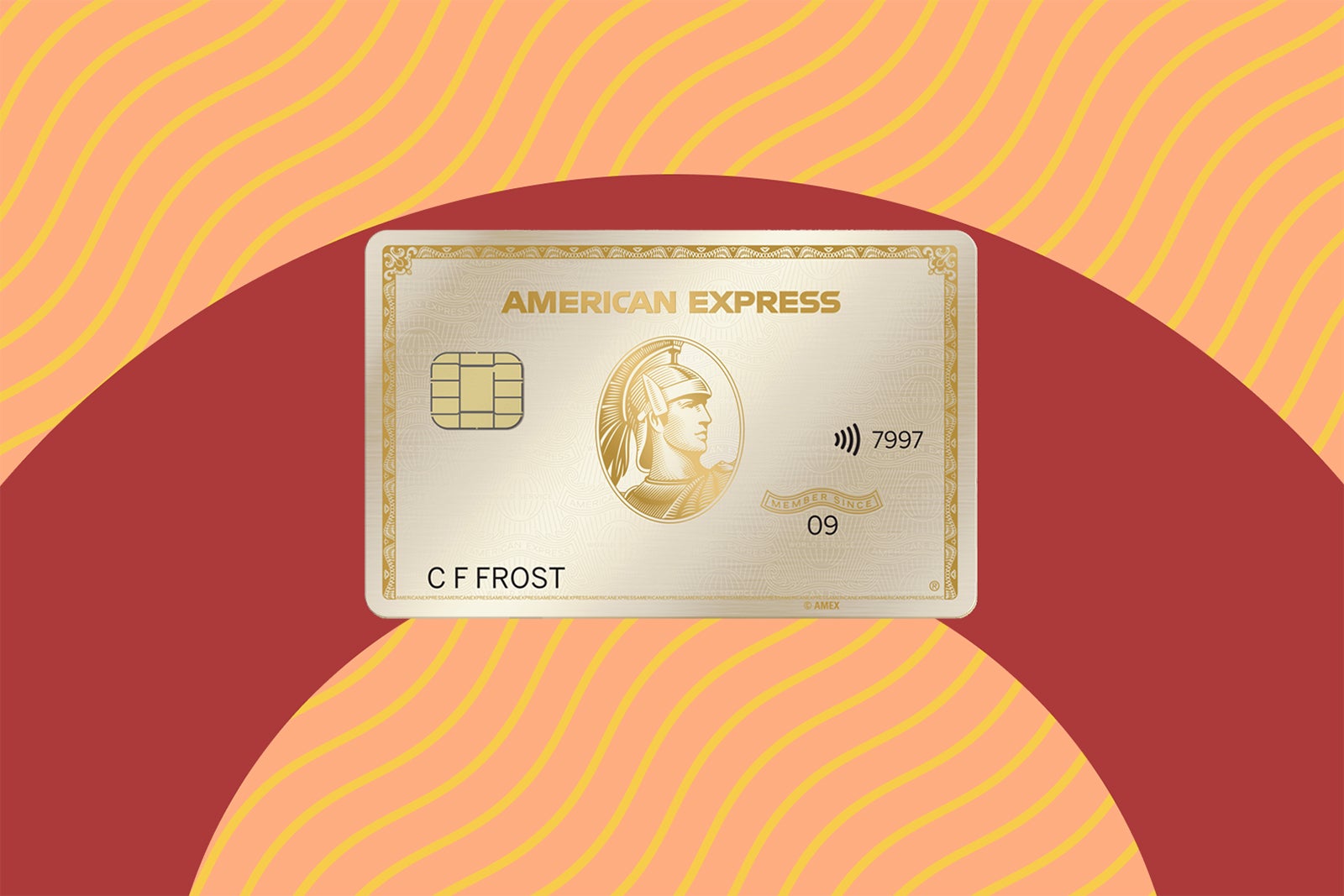

Best Amex White Gold Card Offers & Alternatives

The specified financial product represents a credit card offering from American Express, distinguished by its potential association with benefits tied to American Express's rewards program and a visual design that may incorporate white and gold elements. It serves as a payment mechanism and a line of credit extended to approved applicants.

Such a card could offer benefits such as membership rewards points accrual, travel insurance, purchase protection, and access to exclusive events or services. These features can enhance the cardholder's overall spending experience and provide added value beyond simple purchasing power. Historically, American Express has offered various card products with premium features, catering to different customer segments with varying spending habits and financial needs.

The subsequent sections will delve into the specifics of associated rewards structures, eligibility criteria for acquiring such a product, and a comparative analysis with other credit card offerings within the market. Furthermore, a discussion will be presented on responsible card utilization and strategies for maximizing the card's potential benefits.

- Ice Cream Social Ice Cream

- Millers All Day

- Jules Beauty In Black

- Roper St Francis

- Casa Monica Resort Spa Autograph Collection

Frequently Asked Questions

The following addresses common inquiries regarding the American Express product referenced previously.

Question 1: What is the general credit score requirement for approval?

Approval typically necessitates a good to excellent credit score, generally falling within the range of 700 or higher. However, various factors, including income and credit history length, are also considered.

- Anything Bundt Cakes

- Fine Line Tattoos

- Stuff Your Kindle Day 2024

- Bar Method Berkeley

- Walmart Clinton Nj

Question 2: What annual fee is associated with this product?

The annual fee can vary. Prospective applicants should consult the official American Express website or application materials for current fee structures, as they are subject to change.

Question 3: Are there spending limits associated with the product?

A credit limit is assigned to each approved cardholder, determined by individual creditworthiness. Spending limits are dynamic and can be adjusted based on payment history and other factors.

Question 4: What types of rewards can be earned?

Potential rewards include Membership Rewards points, which can be redeemed for travel, merchandise, or statement credits. Specific reward structures are detailed in the card's terms and conditions.

Question 5: Is there an introductory APR offer?

Introductory APR offers may be available to new cardholders. The terms and duration of such offers vary and should be reviewed carefully before applying.

Question 6: How does one apply for this card?

Applications can be submitted online via the official American Express website or through authorized channels. Required information typically includes personal details, income verification, and consent to a credit check.

In summary, a thorough review of the card's terms, fees, and rewards structure is recommended before applying. Understanding the card's benefits and responsibilities is crucial for responsible financial management.

The subsequent discussion will focus on comparing this offering to alternative credit card options and strategies for maximizing its value.

Maximizing the Value

This section provides practical advice on leveraging the benefits associated with the referenced financial product for optimal value.

Tip 1: Strategic Spending Allocation: Prioritize utilizing the card for purchases that offer elevated rewards multipliers, such as travel or dining, as dictated by the card's specific rewards program. This concentrates points accumulation where it yields the greatest return.

Tip 2: Timely Payment Practices: Consistently paying the statement balance in full each month avoids incurring interest charges, negating the benefits of any rewards earned. Maintaining a strong payment history also positively impacts credit score.

Tip 3: Monitor Rewards Programs Actively: Regularly check the available rewards options and any promotional offers to identify optimal redemption opportunities. Rewards programs frequently evolve, necessitating ongoing awareness.

Tip 4: Leverage Supplementary Benefits: Fully utilize the card's supplementary benefits, such as travel insurance, purchase protection, and concierge services, which contribute significant value beyond rewards points. Familiarize oneself with the terms and conditions of each benefit.

Tip 5: Responsible Credit Utilization: Maintain a low credit utilization ratio by keeping the outstanding balance well below the credit limit. This demonstrates responsible credit management and positively impacts credit scores.

Tip 6: Periodic Card Review: Periodically assess whether the card continues to align with evolving spending patterns and financial goals. Consider alternative card products if the current offering no longer provides optimal value.

Maximizing the benefits requires a strategic approach to spending, responsible payment habits, and consistent monitoring of rewards programs. Adherence to these principles ensures that the cardholder derives the greatest possible value from the card.

The concluding section will provide a comprehensive summary and final recommendations.

Conclusion

The preceding exploration detailed aspects of the amex white gold card, including potential rewards structures, eligibility criteria, associated fees, and strategies for maximizing its value. Emphasis was placed on responsible card utilization, strategic spending habits, and the importance of understanding the card's terms and conditions. The discussion extended to comparing the product with alternative credit card offerings and addressing frequently asked questions from potential applicants.

The informed acquisition and diligent management of financial products, such as the amex white gold card, are critical components of responsible financial planning. Prospective cardholders are strongly encouraged to conduct thorough research, comparing various options and considering their individual financial circumstances prior to application. Furthermore, ongoing monitoring of spending patterns and rewards programs is essential for ensuring sustained value and optimizing financial outcomes.

- Will C Wood

- Somerset Regional Animal Shelter

- Poochies Pet Park

- El Farito Beach

- Six Flags Hurricane Harbor Concord Tickets

Amex Refreshes The Gold Card White Gold Option; Annual Fee and

American Express Gold card refresh A complete analysis of the changes

New American Express Limited Edition White Gold Card amex YouTube