Your Guide: Colorado Springs Sales Tax (2024 Update)

The levy collected on taxable goods and services within the city limits directly funds municipal operations. This revenue stream supports essential public services such as infrastructure maintenance, public safety initiatives, and community programs. For example, a purchase of clothing or a meal at a restaurant within city boundaries is subject to this assessment, which is then remitted to the city government.

This source of municipal funding is vital for maintaining the quality of life for residents and visitors. It allows the city to invest in projects that enhance public spaces, improve transportation networks, and ensure the availability of essential services. Historically, reliance on this form of revenue has provided the city with a degree of financial autonomy and flexibility in addressing local needs.

Understanding the nuances of this system, including applicable rates, eligible exemptions, and reporting requirements, is essential for both consumers and businesses operating within the municipality. Further details regarding specific tax rates, permissible deductions, and compliance procedures will be addressed in subsequent sections.

- Market 32 Sutton

- Browns Orchard In Loganville

- Best Cheesesteaks In Philly

- Stuff Your Kindle Day 2024

- Ts Adriana Rodrigues

Frequently Asked Questions Regarding the Colorado Springs Sales Tax

The following addresses common inquiries related to the municipal levy imposed on taxable transactions within city limits. It is intended to provide clarity on its application and relevance.

Question 1: What is the current rate?

The current municipal levy is a specific percentage of the purchase price for taxable goods and services. Consult official city resources or the Colorado Department of Revenue for the most up-to-date figure.

- Bmw Stands For

- Atlantis Resort Map

- Feast Of Dionysus Painting

- North Austin Toyota

- Byron Donalds Town Hall Shouting

Question 2: What types of purchases are subject to this levy?

Generally, tangible personal property and certain services are subject to the assessment. However, specific exemptions may apply, dependent on the nature of the goods or services, and the applicable regulations.

Question 3: Are there any exemptions available?

Yes, various exemptions exist. These may pertain to specific types of organizations, such as non-profits, or to particular categories of goods, such as certain food items. Eligibility criteria are defined by municipal and state ordinances.

Question 4: How is this levy collected and remitted?

Businesses collect the levy at the point of sale and are responsible for remitting it to the appropriate governmental entity. The frequency of remittance is determined by the business's sales volume and the regulations established by the Colorado Department of Revenue.

Question 5: Where does the revenue generated from this assessment go?

The revenue is allocated to fund various municipal services, including public safety, infrastructure maintenance, parks and recreation, and other essential government functions. The allocation is subject to budgetary decisions made by the city council.

Question 6: How can one verify if a business is correctly collecting and remitting this levy?

Consumers can request a receipt detailing the amount collected. Businesses are required to maintain accurate records of their sales and remittances, subject to audit by the appropriate authorities.

Understanding the intricacies of this tax regime is crucial for compliance and informed financial decisions. Resources are available to assist taxpayers in navigating the applicable rules and regulations.

The subsequent section will delve into the implications for businesses operating within city limits.

Navigating Sales Tax in Colorado Springs

The following provides guidance on effectively managing obligations and understanding implications associated with the municipal levy imposed within city limits.

Tip 1: Maintain Accurate Records: Meticulous record-keeping of all taxable transactions is crucial. This includes sales invoices, purchase receipts, and exemption certificates. Accurate records facilitate compliance and simplify potential audits.

Tip 2: Understand Nexus Requirements: Establish whether a physical presence or economic activity creates a requirement to collect and remit. Online retailers and out-of-state businesses should carefully assess their activities in relation to nexus rules.

Tip 3: Stay Informed of Rate Changes: Municipal rates are subject to change. Regularly consult official sources, such as the city's website or the Colorado Department of Revenue, to ensure accurate collection and remittance.

Tip 4: Properly Classify Goods and Services: Correctly categorize items sold or services provided. Some items may be subject to specific exemptions or reduced rates, requiring accurate classification to avoid errors.

Tip 5: Utilize Available Resources: The city and the Colorado Department of Revenue offer a range of resources to assist businesses. These include online guides, workshops, and direct support channels.

Tip 6: Be Aware of Exemption Certificates: Obtain and properly validate exemption certificates from eligible customers, such as non-profit organizations. Ensure the certificates are current and accurately reflect the customer's exempt status.

Tip 7: File and Remit on Time: Adhere to filing deadlines and remittance schedules. Late filings or payments may result in penalties and interest charges. Utilize online filing systems to ensure timely compliance.

Properly managing responsibilities ensures compliance, mitigates the risk of penalties, and contributes to the city's financial stability. Businesses and consumers alike benefit from a clear understanding of applicable regulations.

The concluding section will summarize the key points and offer final considerations regarding this specific local levy.

In Summary

This exposition has detailed various aspects of the levy on taxable transactions within city limits. It has encompassed its purpose, applicable rates, eligible exemptions, collection procedures, and the allocation of generated revenue. Understanding nexus requirements, maintaining accurate records, and adhering to filing deadlines are crucial for businesses to ensure compliance. Consumers benefit from awareness of the assessment's application and its impact on municipal services.

Continued vigilance and proactive engagement with official resources are necessary to navigate evolving regulations. This revenue stream remains a vital component of the city's financial framework, supporting essential public services and community development. Further inquiry and adherence to established guidelines are encouraged to maintain fiscal responsibility and contribute to the economic well-being of the municipality.

- Jonathan Brandis Death

- Desert Edge Football

- Wonderland New York

- Heb Lufkin Tx

- Browns Orchards Farm Market Loganville Pa

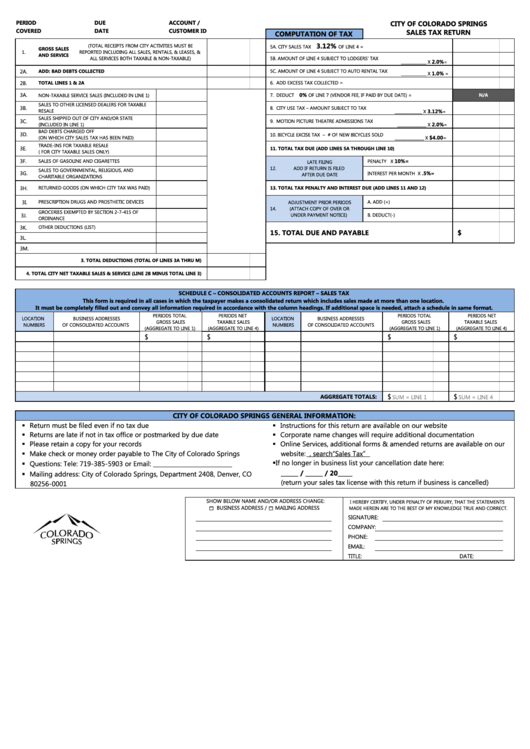

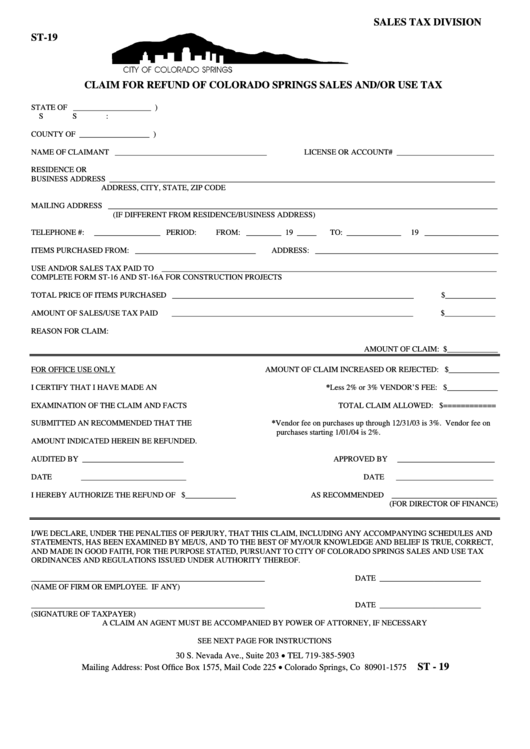

Sales Tax Return City Of Colorado Springs printable pdf download

Sales tax rate changes in Colorado TaxOps

City Of Colorado Springs Sales Tax Catalog Library